Incorporate your Company (C-Corp or S-Corp)

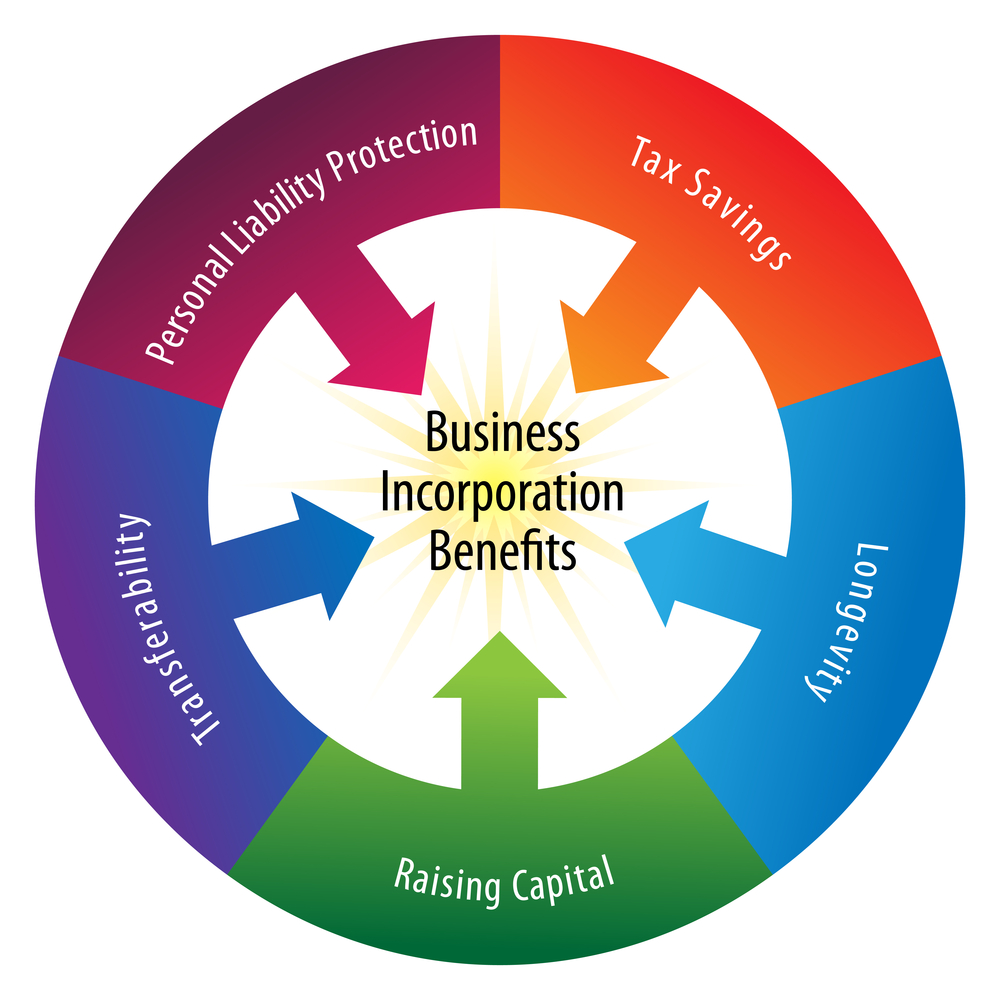

Description

We will take care of the paperwork and the filing of your documents.

The label, "C-Corporation" merely refers to a regular, state-formed corporation. To be formed, an Incorporator must file Articles of Incorporation and pay the required state fees and prepaid taxes with the appropriate state agency (usually, the Secretary of State).

An S Corporation begins its existence as a general, for-profit corporation upon filing the Articles of Incorporation at the state level. A general for-profit corporation (also known as a 'C corporation') is required to pay income tax on taxable income generated by the corporation. However, after the corporation has been formed, it may elect "S Corporation Status" by submitting IRS form 2553 to the Internal Revenue Service (in some cases a state filing is required as well). Once this filing is complete, the corporation is taxed like a partnership or sole proprietorship rather than as a separate entity

You will receive hard copies of your CORPORATION package via mail.

You must be logged in to post a review.

Reviews

There are no reviews yet.